Fintech, short for “financial technology,” is one of the most fascinating technology areas today. Consumers rely heavily on fintech apps for activities as diverse as mobile banking and online shopping. With an expected $10.52 trillion in digital transactions by 2025, the financial technology industry is growing at an exponential rate.

When Is it Time for You to Building a FinTech App?

Building a FinTech app has recently skyrocketed in popularity worldwide. Financial institutions have been able to pioneer ground-breaking uses of digital technology because of the proliferation of smartphones.

In light of the recent uptick in investment and focus on the financial sector, it is crucial to comprehend the factors that contribute to the success of fintech applications.

What Makes it a Grand idea for Investment?

The IT industry is rapidly adopting blockchain and digital currencies. Many industries may benefit from blockchain-based technologies in the future. Numerous sectors, such as healthcare, insurance, real estate, and banking, are included here.

“Fintech” refers to an app that offers financial services to its users via the integration of financial technologies. More resources have been allocated in recent years to the FinTech app. If you’re considering making an app for financial technology, you should know what’s involved. Check out these various apps and talk about what makes them unique.

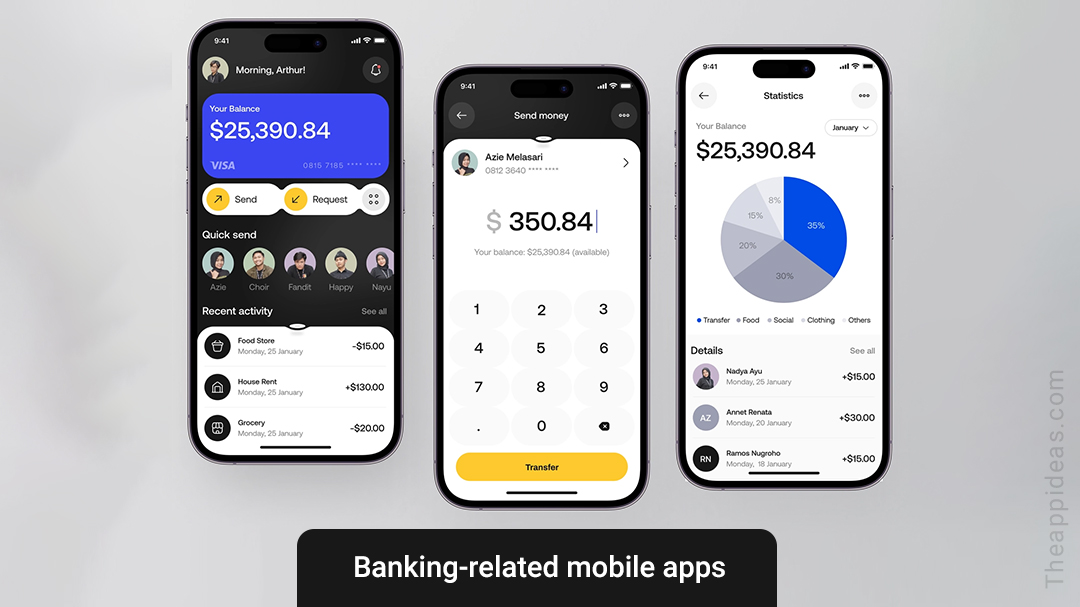

Technologies central to the creation of banking-related mobile apps

As a category, building a FinTech app are distinguished by their extensive use of state-of-the-art features and tools. The following are the most essential pieces of technology to consider when making a fintech payments app.

Application of Machine Learning and Artificial Intelligence

To put it in context, AI is not a new concept. However, only recently, thanks to developments in data collection and processing technology, have fintech firms started using it. Machine learning is one of the many subfields of artificial intelligence (AI). The field of artificial intelligence, known as machine learning, allows computers to learn new skills and knowledge from data without being told what to look for.

Blockchain

One way in which blockchain technology is reshaping the financial sector is by altering the means by which information is stored, transacted, and transmitted. Blockchain has no central point where it can be attacked or compromised because it is decentralized and distributed across multiple nodes or locations. Having something that can’t be changed over time helps establish credibility in a business relationship. Users can only access their own encrypted data rather than the entire database. All transactions are verified through network consensus before being added to the chain, making it difficult for identity thieves to steal anyone’s personal information.

Chatbots

Online banking, digital payment systems, and chatbots are just some of the fintech innovations that have emerged in recent years. Chatbots are AI-enabled software programs that can simulate human conversation with online users in real-time. This rapid ascent in popularity can largely be attributed to chatbots’ superior ability to handle customer service inquiries. They can also be used in many environments.

Gamification

“Gamification” describes the process by which software is made to function more like a game. This demonstrates that, under the right circumstances, people can be motivated by points, achievements, and leaderboards. The use of gamification is a strategy that can aid software development firms in reaching their goals by increasing customer involvement with their offerings. Most of the time, it is used in financial technology.

FinTech Application Types: A Brief

Combine “financial” with “technology,” and you get the term “financial technology.” “fintech” is short for “financial technology,” and it encompasses anything that helps people or businesses conduct financial transactions online or gain digital access to financial data.

As digital tools became more widely used by consumers over the past decade, fintech emerged to help people manage their money and progress toward their financial goals. Meanwhile, consumers have come to rely on fintech for a wide range of uses, from banking and budgeting to investments and lending, in addition to the obvious benefits it provides in day-to-day life.

The many shapes of Fintech

Financial technology, or “fintech,” encompasses a wide range of software used in the financial services industry, including B2B, B2C, and P2P platforms. This article will look at just a few examples of fintech that are causing waves in the banking and insurance industries.

There have been major shifts in the banking sector, a vital part of the financial system, due to developments in financial technology. For example, Plaid’s Auth and Identity have made it easy and fast to open an account and deposit funds while reducing the number of fraudulent sign-ups. On the other hand, neo-banks like Current provide customers with more adaptable checking accounts, faster processing of direct deposits, and even banking products designed specifically for young adults. Traditional fees, which can prevent people from reaching their financial goals, are not charged for any of these services.

Payments

In recent years, cashless transactions have gained popularity. Since the pandemic began, cashless payments have increased dramatically, accounting for 31% of all payments in the US and 60% of all payments in the UK. At the same time, there has been a dramatic expansion in the number of payment-related apps and services available. This is because it is now much easier and faster to sign up and authenticate users. Because accepting payments via direct bank transfer is much cheaper than accepting payments via credit cards.

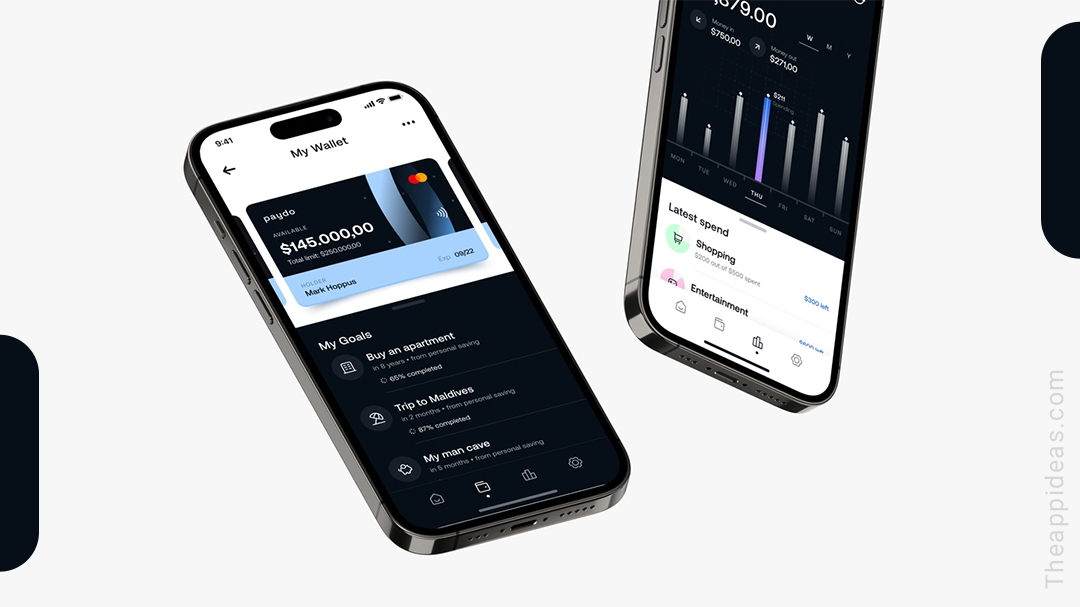

Apps designed for personal financial management (PFM) make it much easier for users to stay up to date on their financial situation by centralizing data from multiple accounts in a single dashboard. A person’s financial situation can be better understood with the help of these services, which aid them in organizing their finances, making budgets, and so on.

Wealth

By utilizing fintech solutions that help them aggregate data from segregated accounts, financial advisors and wealth management platforms can increase their assets under management (AUM) and better serve their clients. For instance, Atom Finance offers its customers a set of tools that together make it easier to learn about and manage all of their investments in one place. Stash is a subscription-based platform that gives users easy, low-cost access to various investment, education, and financial advice-related products and services.

Lending

Because it takes so much time and effort to collect information on applicants’ incomes, account balances, and asset histories, lenders often struggle to obtain a complete and accurate picture of their applicants. Also, it can be a hassle to get borrowers to link their bank accounts so that money can be transferred and money can be paid back.

Aspects of Financial Technology’s Impact

As a result of making the full range of financial services accessible to consumers, fintech has carved out a sizable niche in people’s day-to-day lives. Plaid found that 8/10 people who use fintech services report feeling like they fit naturally into their routines.

Guidance You Would Need to Building a FinTech App

What does the term “Fintech” actually refer to? How Might This Affect Future Payment Methods?

We use the term “fintech” to describe the hybrid of cutting-edge technology and conventional banking services. Fintech, in other words, is the use of technology to streamline and speed up the provision of financial services.

Artificial intelligence (AI), machine learning (ML), and blockchain are examples of cutting-edge technologies. That will be used to automate and enhance the delivery of financial services.

Mobile banking, lending, trading, and other financial services provided by fintech companies attract customers due to their convenience, security, and scalability. Due in part to this, the financial technology industry has expanded.

- You should figure out who you want to sell to

Before diving headfirst into the development of your financial technology application, you need to consider your target market carefully. Invest some time in learning about the functionality of the app type you intend to create.

- Check for Legality

Having a firm grasp on what is legally permissible in this space is essential before committing to the features of your app.

Legal certainty is essential for the fintech solution you intend to develop

This is because most countries have their own unique set of laws and regulations that must be followed. In addition, various methods of financial protection are employed by various nations to track adherence.

-

Identifying your competitive edge.

If you’ve gotten this far, you can start thinking about how to differentiate your fintech app from the competition.

To achieve this goal, you should conduct extensive market research. Including analyzing and evaluating your competitors; analyzing the pros and cons of their apps.

To try to find issues in competing for financial app development and develop an idea for the app. That will set you apart from the competition by providing a better solution to a problem.

-

In the fourth stage, you will define the necessary capabilities

Market research is complete, and your app’s intended use is established. It’s time to decide which financial technology features are necessary.

-

Gather a capable team of people to work on the problem

The term “fintech” is an abbreviation for the broader industry that combines financial services and technological innovation. You can build the answer you require by figuring out how to best pairing these two components.

-

You’ll choose the technology stack that’s right for you

The technology stack must be carefully considered when building a FinTech app. Because there is so much to select from, you might end up with the wrong item. And it could have some extremely dire consequences.

-

Developing a price estimate is the seventh stage

Late in the application’s development, when funds are more limited, unforeseen obstacles can arise due to insufficient resources.

-

Build a Minimum Marketable Product

You should put your app idea through its paces before releasing a full-fledged financial technology solution. For this reason, a minimum viable product (MVP) version of the app is created.

-

Build, fix up, and polish

As opposed to the preceding actions, this one will continue for the foreseeable future. Even after you’ve released your fintech app, you should keep adding new functionality. Instead, upgrade and improve it constantly as you receive constructive criticism.

Factors Influencing the Cost of Building a FinTech App

There has been a complete upheaval in the financial services sector due to fintech, which has spawned a new multibillion-dollar sector. The financial sector as a whole has grown at an exponential rate as a result of this game-changing technology allowing banks to offer innovative new services to their customers.

How much space will you need in your budget to develop a fintech app?

The cost of making a financial technology app is challenging to estimate. The fact that every business has its own unique needs and goals influences the total cost of building a FinTech app. A number of factors, including the nature and scope of the app, its features, the location of the app development company, the app’s quality of performance, and the length of time it took to create, all contribute to the final price tag.

A custom FinTech app that provides users with a simple and secure means of making online purchases could start at a minimum of $40,000. One can learn it in as little as three to four months. On the other hand, it may cost between $30,000 and $50,000 to create a banking app with a relatively basic interface and set of features.

Costs and Benefits of Various Financial Technology Applications

A financial app’s development costs can range widely, as mentioned above, depending on the specific features and functionality desired by the developer. The following table provides a rough estimate of the costs involved in creating some of the most popular FinTech apps currently in use, including banking, lending, investment, personal finance, and insurance apps. Read on to know more about it.

Mobile Money Management Applications

Digital banking or internet banking applications give you quick and easy access to any and all financial services you could ever need. Online services have made it possible to do a wide variety of tasks, such as opening an account and applying for a loan.

FinTech banking app development costs can vary from $30,000 to $300,000, depending on the project’s degree of complexity.

Loaning Application Software

Growth in the P2P lending sector has been spectacular recently. In the near future, thanks to the partnerships currently being formed by businesses, customers will be able to apply for loans through digital channels. Despite the high stakes, the process of lending money can be simplified.

Use Cases in Individual Finances

Personal finance apps have made it much simpler for consumers to keep track of their money. It is possible for individuals to monitor their financial situation, plan for the future, and commit to living within their means by keeping a budget and sticking to their financial plan. These programs serve as digital diaries, letting users keep track of and analyze their money flows in real-time. Costs for the creation of a custom financial app by a firm that focuses on the building a FinTech app for businesses typically range from $60,000 to $300,000.

Financial Apps

Users can use these apps to purchase a wide range of services at a concession. In the future, financial institutions like mutual funds may provide their clients with access to such investment software.

Features in your Fintech App

An increase in mobile phone usage has led to a boom in innovative financial services for smartphones. In recent years, the total number of mobile transactions has skyrocketed. With the rise of neo banks and super apps catering to digital payments, research indicates the global growth of finance apps is on the cusp of a tremendous expansion. As the use of digital payment methods increases, this growth is anticipated.

As of 2023, financial institutions should strongly consider implementing the following features into their mobile banking applications to keep up with customer preferences:

-

A streamlined layout and straightforward navigation

The first and foremost requirement is an intuitive and easy-to-navigate user interface. Numerous apps present users with a jumbled experience and poor directions, prompting them to uninstall the apps in question. The app should make it easier to get around by including a search function that can be used by typing in a query or using the device’s microphone to ask questions.

-

An Adaptive and Customized Adventure

The ability to tailor the app to each individual user is currently the most crucial feature. The younger demographic is essential, and this feature may help attract and retain them as customers. Consider adding dynamic virtual assistants and personalized insights within the app, adapting to each user’s spending habits and income.

-

Replacements for Customer Support

The best mobile banking apps offer helpful support in a number of different ways for their customers. Customers will have less trouble getting in touch with the banks should they have any inquiries or problems.

-

Communications (Text, Email, etc.)

Notifications and alerts are crucial for keeping in touch with customers and promoting services that are well-suited to their needs. If the alerts pop up too often or are too insistent, customers may become frustrated. There needs to be a way for users to select or set preferences for the types, timing, and frequency of notifications they receive.

-

Improved Login Security, Improved Password Policies

After a meteoric rise in the number of data breaches, cyber thefts, and hackers, security has emerged as the most crucial trait to have. Customers will likely want assurance that their personal information is safe with you. If apps on mobile devices can provide the highest level of security, then users can use their devices without worry.

-

Electronic Money Transfers

In addition, digital payment may rank highest on the list of priorities for most customers and is thus an indispensable feature. In this cashless era, it is imperative that all mobile banking apps provide convenient access to a variety of digital payment alternatives. With including mobile wallets, UPI, and other similar services.

-

Inter-Peer Transfer of Funds

As a result of the pandemic, fewer people are willing to carry cash and those who do tend to keep as little as possible on hand. P2P payments, also known as peer-to-peer payments, enable customers to send and receive monetary transfers between themselves and other users of the same platform, typically via a mobile application.

-

Language Preference around the World

About 72% of Indian consumers say that they are hesitant to use digital applications and make digital payments due to a lack of fluency in English. And general discomfort with the internet as barriers to doing so. With the rise of mobile banking in underserved areas, it may be prudent to create an app with multilingual support to ensure that the digital ecosystem is available to all.

-

Management of Accounts

Personalizing your interactions with each customer is crucial if you want to provide them with a one-of-a-kind experience when using your product or service. Because of this, banks and credit unions can now offer customers a custom account management portal that can be tailored to their specific needs.

-

Finder of ATMs

Despite its apparent simplicity, the ATM locator is an extremely useful tool that the vast majority of customers require. Moreover, it can be used to showcase customer service, an activity that, with the help of VR, can be made a lot more interesting.

Suppose you have a well-designed mobile banking app that includes the above critical components. In that case, you will find it much simpler to attract new customers, stay forward of the competition, and provide an outstanding experience for your existing clientele.

Time Required for FinTech Mobile App Development

Transactions conducted online have grown in importance in the modern business world. Rapid progress is being made in the areas of online banking, investment websites, and loan and other financial transaction applications. For the time being, investing in the research and development of building a FinTech application software is crucial strategy. For financial service providers and a highly desirable option for entrepreneurs.

Time required for each phase of creating a fintech app’s development cycle

Once you’ve tracked down a firm that specializes in the building a FinTech app, you need to evaluate your project individually across the following stages:

Preparation Design Creation and Evaluation

This necessitates evaluating how long it will take to implement each successive step, beginning with the idea for the app.

Stage One: Preparation

This is the most crucial stage in determining when an app will be created. Both the developers and the end users are given equal consideration. We aid in defining the scope of the project and establishing baseline requirements at this phase. It’s a three-week process, gives or take.

Collecting and analyzing information about the product, the industry as a whole, the competition, and the target audience is an important part of this app development phase.

Hybrid apps are web apps built with cross-platform development frameworks like Flutter and React Native. An app developed specifically for a mobile platform is known as a “native app” (Objective-C, Swift, and Java for iOS apps and Kotlin for Android apps). Up to 80% of the total time needed to develop the app can be attributed to the discovery phase.

UI Kit

The UI kit’s graphical user interface components allow users to take advantage of new capabilities. Checkboxes, menu bars, icons, and other helpful UI elements are all part of the user interface kit that makes up an application.

This step is essential, but how long do you estimate it will take you to create a financial technology app? This stage of design can take anywhere from forty to eighty hours to complete.

It’s tough to give an exact time frame for building a FinTech app because each project is unique and has its own requirements. Some of these variables include adding new features or resources, such as modules, APIs, or external tools and services. Another thing that will affect how long it takes to make a product is how much it needs to be link with other software systems.

There are a lot of leeway’s when it comes to timeliness provided by your companion

Last but not least, one of the most essential considerations when planning bespoke software development timelines. Whether or not the organization plans to use its own in-house technical resources. Hire developers from another organization, or hire a freelance developer. Having your own company’s software engineers work on your project has many advantages because they already have a deep familiarity with your company’s needs and the technologies that will be used to fulfill those needs.

Estimated Cost to develop an app

You want to building a FinTech app, but you need to know how app prices are established, right? If that’s the case, then you’ll definitely find a lot of helpful data here. Costs vary widely depending on a number of factors, and this article examines some of the most important ones, including the type of app being developed, the location of the app’s development, and other complexities. When you’re done reading, you’ll have all the info you need to make the best decisions possible for your business.

Approximately 6.6 billion people around the world currently use smartphones, making mobile applications extremely common. Given how popular they are and how valuable their input is, ignoring them would be a mistake.

Nonetheless, knowing how much it costs to create an app is the first and most crucial step. It’s one of the first things people who have an idea for an app want to know when they come to us.

The word “tentative” is appropriate here because so many variables can affect the final cost, including the type of application, its functionality, its level of complexity, the vendor selected, and the approach taken during development.

A total of seven variables impact the cost of a mobile app.

The complexities of making mobile apps

Building a simple app takes less time and costs less money. However, the time and money required to develop your mobile app will rise if you want to include sophisticated features.

Initial cost estimates for a number of critical components

If we assume a rate of $40 per hour, this section provides a rough estimate of costs to develop a mobile app. Broken down by the various features found in the typical app.

Territories in Development

Behind the variation in mobile app development costs across regions is the varying hourly rates charged by programmers. Compared to the USA, the UK, and Australia, prices in India and other parts of EU are obviously much more reasonable.

When compared to the going rate in these areas ($120-$150/hour), the cost to create an app is significantly lower.

Modalities for Progress

If you think the time and money spent on creating a mobile app has nothing to do with the approach taken to its creation, you’d be wrong. One must always keep the development strategy in mind when building a FinTech app.

Consulting a freelancer appears to be the most economically sensible option on the table. However, this comes at a price. Freelancers have no loyalty or responsibility to their employers. The correctness of the app’s construction cannot be guaranteed. Because of this, it is recommended to work with a firm that focuses on app development. Spend less money and have more control over your mobile app’s development by going this route instead of hiring an internal team or local agency.

There are many positive outcomes that can result from implementing FinTech. These outcomes range from increased efficiency and security to better accessibility and convenience for customers. An evidence suggests that financial technology will be a significant factor in shaping the future of the financial sector. Learn about the cutting-edge innovations in FinTech and how they can help your company ahead of the competition. Finding a reliable app development partner can be challenging. There’s a lot to consider, and it can be challenging to keep everything straight.

Some studies estimate that by 2030, the financial technology industry’s annual revenue will have doubled from its current levels in the billions of dollars. By fusing cutting-edge technological advancements with applications or financial services, financial technology has helped businesses, especially start-ups, disrupt a previously dominant industry and, as a result, offer superior financial services to their customers. In the next part of this article, we’ll take a closer look at financial technology.

Hidden expenses associated with using mobile apps development

The following are not-to-be-ignored costs are involved in creating a mobile app:

- Integration fees for external services are an example of functional costs. Annual fees can range from $6,000 to $80,000.

- Maintenance costs include things like fixing bugs, spreading updates, and covering server costs. These annual upkeep expenses average out to about 20% of an app’s initial development budget.

- App promotion costs are those you incur to reach potential users.

They’re responsible for about 40% of annual development costs.

Features of the Fintech App Development:

- In the top spot are require specifications and other prerequisites.

- It may take a few weeks to write and manage the specifications. The following are some things you should include in your brief when discussing how to building a FinTech application:

- Objectives and benchmarks for assessing the project’s completion

- In an RFP (request for proposals), you are essentially asking potential vendors to submit bids in a specific price range.

- Confidentiality Agreement

- Approximately the second delivery date. Wireframes

- The earliest visual iterations of the product’s concept are rough sketches called wireframes. It helps both customers and designers visualize the finished product exactly as you envisioned it.

So, Finally, What is the Cost for Building a FinTech App?

The importance of building a FinTech app in the business world is defined by every action, no matter how small. You should know that the price of making a mobile app can range from $20,000 to $60,000, but the average cost is $35000.

The financial technology industry is booming with innovation, and new ideas are constantly being shaped into app formats. As time goes on, the significance, usefulness, and necessity of financial technology become more transparent. Feeling overwhelmed by all the new financial terms, from cryptocurrencies like Ethereum and Bitcoin to non-fungible tokens (NFTs), is normal. You are not alone. Constant innovation in the form of new specialized financial software solutions has been driving the rapidly growing field of fintech.

Due to rapid technological advancement and decreasing costs associated with the development of financial technology applications. The potential for further disruption in the financial technology industry is quite substantial. By 2030, the financial technology market is expected to be worth $699.50 billion, and the number of customers using digital banking services is projected to rise from $197 million in 2021 to $217 million in 2025. The FinTech mobile application development and updating cost with the latest technologies and most cutting-edge solutions is predicted to be between $60,000 and $100,000. Up to $250,000 may be needed to process a very complex financial application.

If you need a financial technology app, go no further than The App Ideas. We guarantee the highest quality service for your fintech app. Our team of developers is expert of industry veterans. And we are committed to providing you with the finest possible lie-detection software solution at the most affordable price.

So go for it now!